Contents

3. Board of Directors: Leading the Sustainability Agenda

Overview

This chapter focuses on the internal aspect of mining companies, exploring how board compositions have changed over the past years, and very positively so, concerning their ESG expertise. It also discusses how the board of directors can continue to provide leadership and oversight of the ESG agenda going forward.

The Maturity of Board ESG Skills Is Evolving

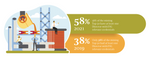

In our inaugural report, From Risk to Reward, Egon Zehnder’s Mining & Metals practice analyzed board composition data from 2019 on the Top 50 mining companies. We found that only 38 percent of boards had at least one member with ESG relevant credentials. Our refresh of this analysis in 2021 shows an encouraging 20 percentage point increase to 58 percent of the mining Top 50.

Source: Egon Zehnder Analysis

Furthermore, companies with at least one ESG director in 2019 have since added more board members with ESG relevant credentials, ensuring a more balanced representation at board level of the wide-ranging ESG landscape. This nuanced and evolved approach was observed among some of the industry’s biggest companies: BHP, Rio Tinto, Fortescue and Newmont. It signals a departure from the narrow approach to ESG seen in our 2019 analysis of mining boards appointing directors who specialized in environmental issues alone.

With the overall increase in ESG credentials on mining Top 50 boards, our 2021 analysis took a deep dive into the range of skills and experience this talent pool brings. ESG board members were broadly grouped as either directors with industry experience in Health, Safety & Environment (HSE) roles, or those who bring an external perspective beyond HSE. Given that 65 percent of ESG directors belong to the latter category, we further classified this group into six sub-categories: Governance, Climate Action, Sustainable Development, Natural Resources Management, Human Rights and Business Leadership.

Traditionally, ESG-relevant board skills have skewed toward HSE – one of the most prominent and well understood risk factors in the industry. Mining companies today are better placed than many other sectors to manage risks associated with HSE, and they have done so for many years. The quality of management and board oversight has significantly improved over the years on individual HSE issues that are closer to the company’s internal locus of control.

With the understanding of the interplay between companies and their external environments evolving, a more advanced model has emerged encompassing broader risks and opportunities. As a recent Egon Zehnder report notes, “Each letter in ‘ESG’ has become even more pertinent in recent years, and even more so in the past months, forcing boards to debate hard questions around a corporation’s public stance and response, responsibility to both its employees and customers, how to effectively support their CEOs, and how much time to dedicate to these issues in the boardroom. We have observed the core director skills set broadening to more complex categories such as climate action and human rights.”26

“In my view and from experience, over the coming five years, climate change, environment and social responsibility cannot be put aside or ignored by any board in any sector, be it banking or mining.”

Anne Kabagambe

Former World Bank Executive Director and Barrick Gold Non-Executive Director

Balanced Approach to ESG at the Board Level

The shift to broader ESG skills depicted in the infographic “Directors with ESG credentials on Mining Top 50 Boards” indicates how boards are thinking about the future, ensuring that they keep up with both their organizational requirements and expectations of the wider stakeholder community.

As boards hire more directors with ESG expertise, it is even more important that they think critically about the strategic imperatives the board is solving for. Moreover, board seats are valuable, and organizations should ensure that directors possess not only functional skills, but also broader business and industry leadership experience. Matters that are deemed non-core may be best addressed by technical advisors on an as-needed basis.

When it comes to the right mix of directors on a board, Dorward-King believes that boards should have a mix of diversity and skill sets, which includes a range of ESG expertise. “You want at least one, and preferably more than one, person who has some kind of expertise across the ESG scope, but you also want all other board members to have some level of fluency around the issues and how important they are,” she explains. “You don’t have to be an expert to be able to ask questions and make sure risks are being looked after.”

Rio Tinto Non-Executive Director, Ngaire Woods concurs: “In this industry, you need people who understand the operations involved in mining, but increasingly you also need people who understand how actions today are likely to affect a community in a few years’ time, how to build partnerships, and how to hear all the different voices that are coming up – whether it’s in local communities, or NGOs sitting in London, New York or Washington DC, journalists, investors, governments, different professional groups, and business competitors within a country. It has always been a complex set of relations, but now they are more open for the public to see, and a higher standard is being set for how companies engage with, and think about the impact they have on, those communities.”

Solving for ESG skills should be part of rigorous board succession planning, to be reviewed by the Nominations committee at least once annually. “It takes two to three years to get directors up to speed, so they really need to understand the business no matter where they come from,” says former Newmont CEO and BHP Non-Executive Director Gary Goldberg. “You've got to put a complete succession plan in place for the talent and skills you're looking for.”

As with other core board skills, the board should have a clear understanding of the ESG skills that are relevant to the strategic priorities and risks of the business. Each new director recruitment should be viewed as an opportunity to optimally solve for the organization’s strategic and functional requirements in the long term. “You've got to look at what else an individual brings to the board besides just subject-matter expertise,” Goldberg affirms.

Our infographic titled “Considerations for Board Succession Planning” illustrates the types of questions the Nominations committee should be asking in preparation for director succession. This approach helps the Nominations committee think through optionality and solve for the optimal combination of board skills.

Source: Egon Zehnder Analysis

Ultimately, the board needs to focus on long-term strategies and risks – a core part of this is to acquire the right future-oriented skills, as well as identify directors who represent key stakeholder groups relevant to a company’s sustainability impacts. Nominating committees should recruit directors who have experience in interacting with, or representing, stakeholder groups that offer insights into a company’s material sustainability impacts. This provides the advantage of bringing both relevant expertise and background diversity to the boardroom.

As companies solve for challenges along their value chain and industry supply chain, they must also seek to understand what is on the radar of downstream customers. Bringing onboard expertise from the end consumer’s industry could be an option. In addition, to safeguard product integrity and mitigate supply chain disruptions, leadership experience in logistics or blockchain expertise might become increasingly important. Furthermore, biodiversity expertise will become, and remain, critical for mining companies due to the scale of their surface activities.

Making the Link to Sustainability in All Strategic Matters

As boards mature in their approach to sustainability, it’s clear that appointing one or two individuals with the required expertise is not enough to address the complexities that sustainability issues bring.

Although these directors play a key role in sensitizing and educating the full board on complex sustainability matters, boards should follow a more holistic and encompassing approach to ensure that sustainability is well understood and considered a core strategic imperative in all board decisions. “If a company is just starting on the journey, then it may be that board members are recruited specifically for their expertise, to provide more detailed input and be more hands-on than might be expected if a company is relatively mature in that space so you can be further away,” Dorward-King explains.

The entire board must take a longer-term view and understand how the sustainability agenda plays into the future of the business. Rather than being treated as an isolated topic, sustainability should be an integral part of board discussions and integrated into long-term decision making on strategy and risk. This implies that all directors should have a solid grounding in sustainability fundamentals and the specific implications for the company.

“If boards do not apply an understanding of the implications of both social vulnerabilities and environmental risks, company strategy may get derailed. This could come in the form of a company’s inability to meet production targets or even missing financial objectives due to not achieving necessary permits and regulatory approvals,” Dorward-King says.

An important step to mitigate this risk is to arrange board briefings by experts who specialize in specific sustainability issues that are material to the business. This can enable board members to make the connection between those issues and the possible risks to corporate strategy. Materiality analysis could prove useful in helping directors understand how certain sustainability issues are related to business strategy and how they may materially affect operations.

“It is important for the board to get external input in a very structured way,” says Dhawan. “If your management team is telling you that in our assessment of material risks biodiversity ranks #14 – this implies that it is not very material and that stakeholders don’t consider it material. But if you had an expert panel on sustainability, they are likely to tell you something else. They are the ones looking outside the industry and seeing how quickly these things can change. So, it is the board’s responsibility to challenge management assumptions around materiality.”

This also sends a positive message to the investor community. “It’s encouraging when you see a company acknowledging a particular challenge and seeking to bring in experts or critics to both inform its decisions and be challenged; or to actually work within the organization and be part of its governance,” Matthews notes.

Newmont applied this approach by forming country advisory boards. “When you have a global company with a presence in lots of different countries, it may not be possible to bring all country representatives onto your main board. So, this was a different way to get their expertise and to learn from them,” Goldberg explains. “I think for a bigger company, that's probably a better way to do it.”

Photo courtesy of Anglo American

Sustainability Education for the Full Board

We believe that all board directors should be educated on material sustainability issues to enable thoughtful deliberation at the board level. The full board must be aware of all material risks to both the company and its stakeholders. Fluency in sustainability matters should become a key performance indicator when hiring new board members and upskilling existing board members.

“You shouldn’t be recruiting new board members in any mining company who can’t answer some fundamental questions about their understanding of sustainability issues,” Nelson says. “In a board interview, a potential director should be able to answer the question: ‘What do you think are the material sustainability issues for our industry?’”

For those looking to upskill and learn more, tertiary education and governance associations have formal training programs, and extensive educational material is available through a variety of online sources.

Boards should also find regular opportunities to engage with both internal and external stakeholders on sustainability issues. These interactions can help boards gain a holistic understanding of the key issues that affect a company, as well as mitigate adverse impacts on external shareholders and pinpoint opportunities for creating shared value for the long term. Standard practice is for all directors to visit operations on a rotational basis. To ensure adequate focus on sustainability matters, boards should not only view the visit as operational information gathering, but also maintain a specific focus on the surrounding communities, environmental issues and day-to-day non-operational challenges that are experienced by management on site.

“It is absolutely essential that mining company boards go and visit the operating sites. Until you get out there, you don’t really get to see how the communities are living,” Dorward-King shares. “I’m a strong advocate that boards need to visit their operations and not just the big shining ones, and easy to get to places, but they need to rotate through the different sites.”

Goldberg adds, “At Newmont and at BHP, we do deep dives into a particular operating asset, where we can get down and talk to people on the ground. To me, it's always that triangulation of what you're hearing from management and what you hear on the ground and do the two add up.”

Commitment to Diversity and Inclusion (D&I)

In Egon Zehnder’s contribution to the Sustainability Board Report, consultants Karoline Vinsrygg and Cynthia Soledad state that the issues encompassed by sustainability are so broad and unpredictable—environmental risks, human rights issues, resource management and more –that it is critical for boards to have different perspectives around the table.

A board that is not sufficiently diverse runs the risk of lacking credibility with investors, customers, employees and other stakeholders. This is because it will then only represent the views of a select few who typically come from similar backgrounds or have a similar mindset.

A board that embraces different backgrounds, viewpoints and perspectives includes both demographic and perceptive diversity. Although diversity and inclusion are inextricably linked, they are not the same thing. To unlock the benefits of diversity, a board culture that is truly inclusive provides equal opportunities for all members to contribute valuable insights, ask tough questions and challenge proposals made by management and fellow directors. We believe that a focus on both diversity and inclusion at the Board level leads to more sustainable business practices.

D&I: The Antidote to Groupthink

Avoiding “group think” is one of the most important benefits of adding diversity to the board, and it is also key to ensure that companies prioritize sustainability by adopting a broader world view. Companies must consider the history and circumstances that have shaped the demographics and nature of talent available from underrepresented groups.

Nomination committees must not only understand the tradeoffs they may have to make, but also look beyond traditional director archetypes to explore the spectrum of skills and experience they can reasonably gain by making a diversity hire. As an example, Goldberg shares that “Companies can benefit from getting younger people at the board level who are more tech savvy. We did that at Newmont by bringing in Sherry [Hickok] from General Motors on to our board. She is now with GE Renewables. At the time she was not even 40 years old, and she brought an entirely different perspective.”

Source: Egon Zehnder Analysis

Avoiding the Tokenism Trap

We have seen examples of companies – under pressure from shareholders – seeking to hire an experienced director who is ideally female, preferably of ethnic descent, with ESG relevant skills, and even better if she has technical leadership or CEO experience. While this “four birds one stone” approach is an indication of companies taking a step in the right direction, such expectations often point to a lack of ongoing board succession planning and indicate that boards may only be interested in making a token or “all in one” hire. This places a large portion of the director recruitment focus on a small number of eligible directors.

This handful of board candidates who meet these criteria tend to be well entrenched in the prevailing corporate culture. They often have several board roles (current and former) under their belts, as companies resort to recycling this limited pool of talent. Such candidates tend to be overboarded and may even subscribe to, rather than challenge, the limiting tendency of “group think” on corporate boards. This can be avoided by strategically and purposefully looking at succession planning in an ongoing manner.

Boards are encouraged to be thoughtful on pipeline succession planning, with longer term board recruiting processes that ensure a strategic and diverse slate of candidates reflecting their employee, customer, and stakeholder base. We encourage companies to recruit from new talent pools and look beyond board members’ own networks and historical recruitment practices to help identify diverse director candidates who can share new views and perspectives and different approaches to problem solving. This does not mean hire unqualified candidates or select a board member who brings surface level diversity to the board. It’s about examining a talent pool that has yet to be tapped and is brimming with potential.

Board Governance and Committees

In terms of governance, sustainability oversight should be included across the board structure by firstly, incorporating this into the charter of each board committee, with clear reporting procedures, as well as an agreed scope and mandate. Secondly, disclosure on core sustainability metrics should be promoted based on widely accepted guidelines. Finally, compensation of key executives should be tied to core sustainability metrics.

“We need to constantly be thinking about whether sustainability or ESG and safety have the same prominence that operations, technology, people, growth priorities and finance have,” says Nelson.

While the entire board should actively engage in discussions about the company’s material sustainability issues, formalizing oversight in specific committees allows for key issues to be raised systematically and in-depth. For instance, the audit committee can play an important role in the identification and prioritization of sustainability risks, assigning these accordingly to specific board committees or to the whole board. All board committees should take accountability for diving more deeply into sustainability issues, allocating adequate time to consider longer-term strategic matters. Very importantly, report backs to the board by the committee chair should have sufficient detail and information in them for the full board to track progress in critical areas and gain a holistic understanding of the context.

Oversight of the company’s sustainability strategy should be assigned to a sustainability committee, or its equivalent. Apart from governance oversight, the sustainability committee plays other important roles, as Woods describes: “A sustainability committee that is functioning well will not just be overseeing policies, but also asking ‘Is this really happening; do we know this is happening; are we sure that this is happening?’, and ‘Are we learning to do this better?’. The committee also plays a conduit role. As a board, you are there to represent not only the shareholders’ short-term interests, but also their (and other stakeholders’) long term interests in what the company is doing, how those expectations are changing, how to channel that to the senior management of the company and really push it forward.”

A sustainability committee covers a broad area of focus, and committee members should present a wide array of skills and experience. Where deep skills are lacking, the committee should consider bringing in experts who can advise on specific matters, giving the sustainability committee a baseline to work from. If those matters become more material, the sustainability committee has a trajectory to consider them at the full board.

Enforcing Executive Accountability

The rise of sustainability as a core strategic imperative underscores the importance of governance and the expectations from non-executive directors and management, as well as the interplay between the two parties.

The board does not exist to run the business but should be asking enough of the hard questions to help management think deeply and creatively about critical matters such as sustainability. In addition, the board should not delegate these topics, but ensure that actions are being taken and that intermittent briefings continue on topics that are of critical importance. Conversely, management should not reduce the challenge, but hear the debate and take it onboard. “My job as a director is to challenge where I see things that aren't going the way they should, or management hasn't thought about x or y, and also to support what they're doing well and encourage that,” Goldberg notes.

“You need to have a board that’s willing to ask enough questions and provide enough support and input to ensure that the ship is going in the direction you want to travel, without delving down and trying to do management’s job by instructing on what needs to happen or being too specific about how things need to be done,” Dorward-King explains.

Previously a highly debated topic, today it is widely accepted as standard practice for boards to tie executive remuneration to sustainability metrics. “It’s now got to the point where having KPIs tied to sustainability performance is just a hygiene factor, not a leading factor,” says Dhawan.

An HBR article “The Board’s role in Sustainability,” states that, “The board is responsible for establishing the metrics that will be used to determine promotion and remuneration throughout the organization. Purpose, not simply profits, needs to be rewarded.”27

Boards need to ensure that compensation and rewards are truly tied to those things that are material for the company’s success, which would include delivery management of key social and environmental issues. Setting KPIs that are linked to compensation, having targets that the company talks about and reports publicly – whether it’s in a sustainability report, the annual report or on the company’s website – helps focus management’s attention.

HBR asserts that “Measuring, rewarding or penalizing management’s performance gives useful insight to stakeholders. Companies should disclose the ESG issues that are linked to executive compensation, inform them of the proportion of pay at risk as it pertains to ESG issues, and state whether bonuses are linked to any short or long-term incentive structures.”28

“Boards have to lead the charge and really push management,” says Goldberg. “If the board is not there, or they're not moving there, you may have to change people around. But your executive team also needs to be thinking that way and it starts with the CEO – do they have the right CEO to lead that transition? If they’re not there today, can they get there?”

A Conducive Board Culture

When it comes to transformation, changing systems and processes is generally easier to action, and much more visible and straightforward to measure outcomes. However, an organization’s people and culture remain at the core of whether the transformation will be successful. And people and culture are hard to change, which is why we dedicate a section to look specifically at this topic at an organizational level.

Although organizational culture is shaped by the CEO and executive team, the board plays an indirect role by providing the best possible supervision, decision making support and guidance to executive management. This is underpinned by an inclusive and constructive board culture. To successfully spearhead a company’s journey toward corporate stewardship, we believe that an effective board culture is essential to set the right ‘tone from the top.’

“What you're ultimately looking for is people that get along. They don't have to agree on everything because you don't want everyone pointing in just one direction,” Goldberg shares, “but you've got to have a certain culture at the board where people are comfortable challenging each other constructively and learning from each other. If the board isn't thinking that way, and if top management isn't, then you're going to have a lot more changes to make to set that right.”

Establishing a boardroom culture of respect and transparency fosters innovation by creating a space where honest opinions can be shared without hesitance. This welcomes conflicting views that, in turn, shape direction and produce a powerful shared vision and way forward. Board members should be willing to not only voice their own opinion, but also engage with the opinions of others in order to avoid common boardroom biases such as groupthink.

Board members should view diversity of thought as an opportunity to engage with new ideas and challenge the existing state of affairs, however uncomfortable this might make them feel. PwC’s 2020 Annual Corporate Directors Survey noted that more than one-third of directors find it difficult to voice a dissenting opinion.29 This highlights the importance of ensuring that boardroom dialogue is open and respectful if the board is to deliver best-in-class thinking.

Taking a stakeholder-centric approach to decision-making is key to building resilient board cultures that ultimately create positive impacts for society at large. “Boards need to own this whole agenda, they need to have internal critics within the organization that are empowered to challenge the board, empowered to provide information to the board that is uncomfortable, empowered to have a line of communication that may come up through the CEO but also goes directly to the board. A sophisticated company with the maturity to do that well, will be the one that succeeds in this sector,” notes Matthews.

Organization’s Purpose and Role in Society

Value creation is no longer the sole measure of effective governance, and the board’s charter is expanding to include the company’s societal impact and role in the communities where they operate. This is especially true for mining companies, which typically operate in a country or region for a minimum of 10 years, and more likely 30-40 years.

To create shared value, the board should identify at least three systemic challenges to intentionally think about solving during the company’s long stay in host countries. In doing so, it is important to invite a broad stakeholder group to provide input. Stakeholder activism and a greater desire by key stakeholders, including consumers, employees and local communities to exercise more influence on major decisions is on the rise.

“We don’t work in a vacuum,” Kabagambe explains. “We work in a global community, and almost every five years there are certain things that arise which we cannot ignore. You cannot ignore the COVID-19 pandemic nor the kind of attention that is out there on climate change.”

Once the board prioritizes the top three to five systemic challenges, the company can start building its business case and putting in place the structures, skills, and, depending on the issue, the required culture to address them. “It starts with the company strategy and values,” says Goldberg. “When you become a CEO, you reflect with the board and with your leadership team on what your strategy should be and what your purpose should be. Newmont’s purpose is to ‘Create value and improve lives through responsible and sustainable mining.’ We spent a lot of time with the board and senior management to devise this, and then tested it with our Top 100 leaders. But getting alignment was critical, and it sent a strong message to the organization on what we're about and what it means. How we went through that process and the inclusiveness of that process was important for the board, for the executive team and for the organization.”

Footnotes

26. “The Corporate Governance Exchange” Egon Zehnder, 2021

27. “The Board’s Role in Sustainability,” Harvard Business Review, September–October 2020 issue

28. Ibid

29. “PwC’s 2020 Annual Corporate Directors Survey,” PwC, October 2020